Singapore’s construction demand is set to maintain its momentum this year, ranging from S$47 to 53 billion, similar to 2025, announced the Building and Construction Authority (BCA) on 22 January at the BCA-REDAS Built Environment and Real Estate Prospects Seminar 2026.

At the event, Minister for National Development Chee Hong Tat also announced several initiatives to improve productivity and streamline regulations for built environment (BE) firms, helping them save time, costs and manpower.

Steady construction demand

The sustained construction demand in 2026 will be driven by a number of major projects, including the Changi Terminal 5 (T5) development, Marina Bay Sands Integrated Resort (MBS IR2) expansion, New Tengah General & Community Hospital, Downtown Line 2 Extension and Thomson-East Coast Line Extension.

As at end 2025, preliminary actual construction demand reached S$50.5 billion, within BCA’s earlier forecast of S$47-$53 billion. This was higher than the S$44 billion in 2024. The continued uptrend was mainly attributed to institutional and housing projects.

According to Teo Jing Siong, group director of Strategic Planning and Transformation Office at BCA, the institutional building construction demand is expected to remain strong. Meanwhile, the commercial and civil engineering construction demands are projected to increase.

Other projects likely to be awarded in these three categories (institutional, commercial and civil engineering) include: Tanglin Shopping Centre redevelopment, HarbourFront Centre redevelopment, Home Team Tactical Centre Phase 3A, as well as major roads, viaducts and cycling path networks, to name just a few.

Forecast for 2027-2030

Over the medium-term, construction demand is projected to reach an average of S$39-$46 billion per year from 2027 to 2030. “This presents opportunities for our BE firms, given the strong growth trajectory of our construction sector,” said Mr Chee.

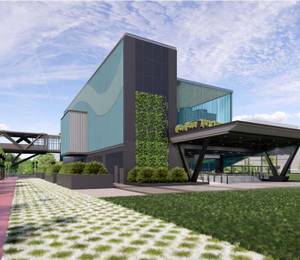

Besides the Changi T5 development and HDB’s build-to-order (BTO) construction, medium-term construction demand is anticipated to be supported by a strong pipeline of large projects, such as the redevelopment of NUH at Kent Ridge, various Junior Colleges, and the development of the new Singapore University of Social Sciences (SUSS) City Campus.

While the medium-term construction demand outlook appears positive, BCA said project schedules may still change due to unforeseen global economic risks. Also, as the Changi T5 development is a one-off project, industry demand could moderate following its completion, potentially reverting to pre-Covid levels.

Based on the contracts awarded in the past few years and the continued strong construction demand forecast for 2026, total construction output is projected to increase to S$43-$46 billion in 2026. The average projected output at S$44.5 billion in 2026 will be around 7% higher than the preliminary estimate of about S$41.7 billion in 2025. The anticipated continued uptrend is expected to be driven by a consistent high level of construction demand since 2023.

Looking ahead, Mr Teo pointed out that “firm must prioritise collaborative contracting practices that strengthen value chain partnerships, enable effective management of complex projects and enhance the jobs for workers in the industry.”

New key initiatives

Mr Chee called on the industry to continue with its transformation journey to bring greater efficiency. “We cannot become complacent,” he stressed. “If we continue business-as-usual, we will soon run into resource constraints, which will then adversely impact the ability of our sector to seize new growth opportunities.

“To deliver on our ambitious building plans, we will need to press on with our transformation efforts to save time, save costs, and to save manpower. Not just the government or industry doing this on our own, individually, but all of us doing this together as an ecosystem.”

To that end, Mr Chee highlighted some new key initiatives for the industry.

A). Updated Productivity Solutions Grant

The Productivity Solutions Grant (PSG) has played a vital role in driving industry transformation in the BE sector. It has supported more than 1,100 firms since 2020 in adopting digital solutions to improve productivity.

“To give one example, with the support from PSG, Novaars International implemented an AI-powered facade inspection system, which provided 30% manpower and time savings,” shared Mr Chee.

From 1 April 2026 to 31 March 2031, the new PSG tranche will be available to help SMEs build more advanced capabilities to achieve higher productivity. It will:

-

Expand support to advanced equipment such as robotics and automation (R&A) that can achieve up to 50% manpower savings for each construction trade activity

-

Include more pre-approved digital solutions in focus areas such as digital contract management and coordinated regulatory approvals, further supporting SMEs in advancing their digital capabilities

-

Raise grant caps to support longer-term adoption of both digital solutions and advanced equipment, enabling SMEs to make more substantial and sustained productivity investments. SMEs that benefitted from previous PSG tranches are allowed to apply again.

B). Collaborative contracting practices

To support the sector in delivering increasingly complex projects more effectively, BCA has been promoting collaborative contracting with more than 20 ongoing and upcoming pilot projects across both public and private sectors.

Collaborative contracting is “a key enabler,” said Mr Chee, “which provides mechanisms for project parties to resolve issues upstream, share risks and savings, and better manage and save on costs, time and manpower.”

For public sector projects, this takes the form of Option Module clauses under the Public Sector Standard of Conditions of Contract. According to BCA, early feedback from pilot projects, including the Ministry of Health’s Punggol Field Nursing Home, found that the stronger collaborations amongst project parties have improved project delivery and helped achieved project completion ahead of schedule.

In more complex and/or private sector projects, BCA has supported the adoption of NEC4, an internationally recognised collaborative contract form adapted for Singapore. Recently, JTC awarded the first NEC4 target cost contract for infrastructure works at Jurong Innovation District’s CleanTech Park to Eng Lam Contractors, allowing project parties to share cost savings or overruns when they occur.

This collaborative approach has also been extended to the facilities management (FM) sector. In November 2025, BCA awarded the first NEC4 Facilities Management Contract (FMC) in Asia to C&W Services (S) Pte Ltd for the BCA Braddell Campus. This sets a new benchmark on how FM services are procured and managed.

“We have seen some good examples and are going to make further progress. And one of the things that we will do is encourage more agencies, more companies to take part in this. This is something BCA and MND will focus on,” said Mr Chee.

He added that firms with more comprehensive transformation plans can also tap on BCA’s Built Environment Technology and Capability grant to build up capabilities in areas such as technology, enterprise and manpower.

C). Enhancing project management skills

BCA is partnering with the Project Management Institute (PMI) to launch an enhanced project management competency framework in the second half of 2026 to keep pace with the evolving needs of the industry.

The enhanced framework will strengthen the existing accreditation scheme by the Society of Project Managers to provide project managers with more structured training and credentials that are recognised both locally and internationally.

“Through this, we will develop a pool of reliable and skilled project managers who can competently help our BE firms deliver projects on schedule, within budget and resources, and also align with quality and safety requirements,” said Mr Chee.

D). BE CARE Charter

Beyond contracts and frameworks, a strong culture is a critical enabler of effective collaboration. To date, a total of 47 firms have committed to the Built Environment Culture for Appreciation, Respect and Empathy (BE CARE) Charter.

Developed by the Taskforce for Architectural and Engineering Consultants, the charter spells out best practices that stakeholders may undertake to promote well-being and cultivate good working relationships.

GuocoLand, for example, has adopted the BE CARE Charter in its Springleaf Residence project, yielding good outcomes. Going forward, the developer will be adopting the charter for more of its upcoming projects and will be introducing a rewards programme in 2026 to recognise consultants that exhibit strong collaboration and deliver quality projects.

E). Pro-enterprise environment

The government is working with the industry to cut red tape, support innovation and help businesses save time and costs. Recent initiatives include Corenet X’s streamlined plan fee computation, improvements to the Temporary Occupation Licence process for show flat sites, enhancements to the CONQUAS framework for private residential developments, and strengthened regulations to better protect prospective homeowners.

In addition to the above, BCA is streamlining processes to further reduce administrative burden on firms. The validity of the Public Sector Panels of Consultants (PSPC) listings will be extended from one to three years for applications submitted from 1 June 2026, reducing renewal frequency and administrative burden. This gives firms greater certainty to plan their manpower, make longer-term investments and develop their professional practice further.

“The sustained project pipeline gives our industry a solid foundation to build on. We are creating an environment where firms can invest in better ways of doing business, whether that is through new technology, better collaboration, or upskilling their teams,” explained Kelvin Wong, CEO of BCA. “At the end of the day, companies that can deliver quality projects efficiently while taking care of their people will be the ones that thrive. The measures that BCA has put in place are designed to help firms work smarter and achieve success.”

“The future of our built environment sector lies not in individual excellence, but more importantly, in our collective ability to innovate, collaborate, and push for a more productive sector, “ asserted Mr Chee, concluding his speech. “Together, we have the tools, we have the talent, and we have the vision and the courage to not just build structures, but to build a thriving and resilient ecosystem.”

All images: BCA