The Building and Construction Authority (BCA) projects the total construction demand (i.e. the value of construction contracts to be awarded) in Singapore to range between S$47 billion and S$53 billion in nominal terms this year. Normalised to real values, 2025’s demand is projected to range between S$35 billion and S$39 billion, which is 0.3%-11.7% higher than pre-Covid levels in 2019.

The strong demand is underpinned by the expected award of contracts for several large-scale developments, such as Changi Airport Terminal 5 (T5) and the expansion of the Marina Bay Sands Integrated Resort, alongside public housing development and upgrading works.

Other projects include high-specification industrial buildings, educational developments, healthcare facilities, mechanical and engineering contracts for the Thomson-East Coast Line Extension (TEL) and Cross Island Line (CRL), and infrastructure works for the Woodlands Checkpoint extension and the Tuas Port.

The preliminary total construction demand for 2024 reached S$44.2 billion in nominal terms, exceeding BCA’s mid-year revised forecast of between S$35 billion and S$41 billion. This was mainly attributed to the rolling out of more public institutional projects, as well as public and private housing projects.

Construction output

Based on the contracts awarded in the past few years and the construction demand forecast for 2025, the total nominal construction output is projected to increase to between S$39 billion and S$42 billion in 2025, up from the preliminary estimate of about S$38.4 billion in 2024.

This anticipated uptrend is expected to be supported by the increase in actual construction demand over the last few years and the expected increase in 2025 construction demand. Normalised to real values, the total construction output in 2025 is projected to range between S$30 billion and S$32 billion, which is slightly higher than that in 2019.

Forecast for 2026-2029

Over the medium-term, BCA expects the total construction demand to reach an average of between S$39 billion and S$46 billion per year from 2026 to 2029.

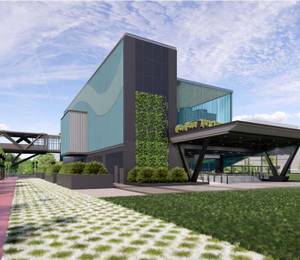

The medium-term demand will continue to be supported by developments such as T5, a steady pipeline of public housing developments, MRT projects like the Cross Island Line (Phase 3) and the Downtown Line Extension to Sungei Kadut, Integrated Waste Management Facility (Phase 2), Tengah General and Community Hospital, Siglap South Integrated Development, Woodlands North Coast industrial estate, redevelopment of various Junior Colleges, commercial building redevelopments, and other urban rejuvenation developments.

While the medium-term construction demand is projected to be robust, BCA said the schedules and phasing of projects are subject to change, particularly due to potential unforeseen risks arising from an uncertain global economic climate. Furthermore, as the T5 development is likely to be a one-off exceptional project over the medium term, overall industry demand could eventually moderate after this period.

Corenet X implementation timeline

Over the past year, the regulatory government agencies have been working closely with industry partners and practitioners on Corenet X, a one-stop digital platform for integrated regulatory submissions for building works. BCA noted that feedback from industry has been useful in refining the processes and the platform.

“Since Corenet X was opened to voluntary submissions from June 2024, 28 projects involving 72 firms across various development types have stepped forward,” said Desmond Lee, Singapore’s Minister for National Development, speaking at the BCA-REDAS Built Environment and Real Estate Prospects Seminar on 23 January 2025, which was held at the BCA Academy.

The hands-on experience gained from going through the new regulatory processes in actual projects were invaluable in strengthening collaboration amongst project teams and fostering better understanding of the new Corenet X requirements, added BCA. Insights gleaned from these projects also helped project parties to review their internal processes to be able to leverage Corenet X for more streamlined workflows across the value chain.

“We recognise that Corenet X entails significant changes to existing workflows, and that some firms need more time to adjust internal processes and familiarise themselves with the new requirements,” said BCA. “In addition, smaller consultancy firms may not have had sufficient projects to try out the new processes during the voluntary submissions phase.”

With that in mind, BCA has adjusted the timeline for the implementation of Corenet X as follows:

-

1 October 2025: Mandatory Corenet X submission for all new projects with gross floor area (GFA) ≥ 30,000 sq m

-

1 October 2026: Mandatory Corenet X submission for all new projects, regardless of GFA

-

1 October 2027: Mandatory onboarding to Corenet X for all ongoing projects

For smaller-sized new projects with GFA below 30,000 sq m, BCA encourages project teams to take the opportunity to make submissions through Corenet X ahead of the mandatory timelines to familiarise themselves with the new process and submission portal.

New NEC4 clauses for collaborative contracting

Aside from Corenet X, the BE sector is also fostering closer collaboration via collaborative contracting. This method facilitates deeper collaboration amongst developers, consultants and builders.

Mr Lee pointed out that “unlike conventional contracting which may inadvertently cause stakeholders to adopt adversarial postures against one another, collaborative contracting provides a framework that allocates risks and gains more equitably.

“It aligns the incentives of parties, builds trust, and encourages everyone to work towards better project outcomes.”

In 2024, BCA, together with NEC, launched an additional set of contract clauses (Y clauses) to adapt the NEC4 contract form with Singapore’s laws. To further support the adoption of NEC4 contracts in Singapore, BCA has developed additional clauses (W and Z clauses) that incorporate local dispute resolution protocols, current government procurement rules, and established local industry practices.

-

W clauses: Dispute resolution options incorporating local dispute resolution protocols and practices, such as the Singapore Infrastructure Dispute-Management Protocol 2018 (SIDP) and appointment of senior representatives for dispute resolution.

-

Z clauses: Additional conditions of contract for project-specific requirements that take into consideration public sector procurement requirements and local practices. This includes the use of eGuarantee template, Progressive Wage Mark requirements and suitable project response timelines.

“More than 15 projects from across the public and private sectors will be piloting collaborative contracting, with five of them piloting the NEC4,” shared Mr Lee.

In addition, BCA Academy, industry associations (e.g. the Society of Construction Law), and Institutes of Higher Learning (e.g. Singapore University of Social Sciences), and other training providers have introduced programmes to build up the relevant skills and competencies in collaborative contracting among firms.

Image: Alexey Komissarov/Unsplash